You Become The Plan Adviser

We Become Your Back Office Partner

You Help People Retire

53

40

44

White Label 401(k) Platform

EIP Private Label Program is A White Label 401(k)

Solution for RIA's & Financial Institutions

Below is all the services we provide for our partners:

We provide ALL essential 401(k) duties, within a platform that is white labeled, for RIA's and other financial institution that offer 401(k) advisory services. Our job is to do the heavy lifting so you can focus on your advisory duties.

Plan Reporting & Recordkeeping

We streamline ongoing plan reporting requirement, plan contributions, withdrawals and individual participant account balances.

Third Party Administration (TPA)

Compliance testing, IRS Form 5500 filing, IRS-approved plan documents, participant disclosures & more.

Wealth Management Integration

From integration with eMoney to ongoing white label emails we work with you to integrate your firm brand into the process.

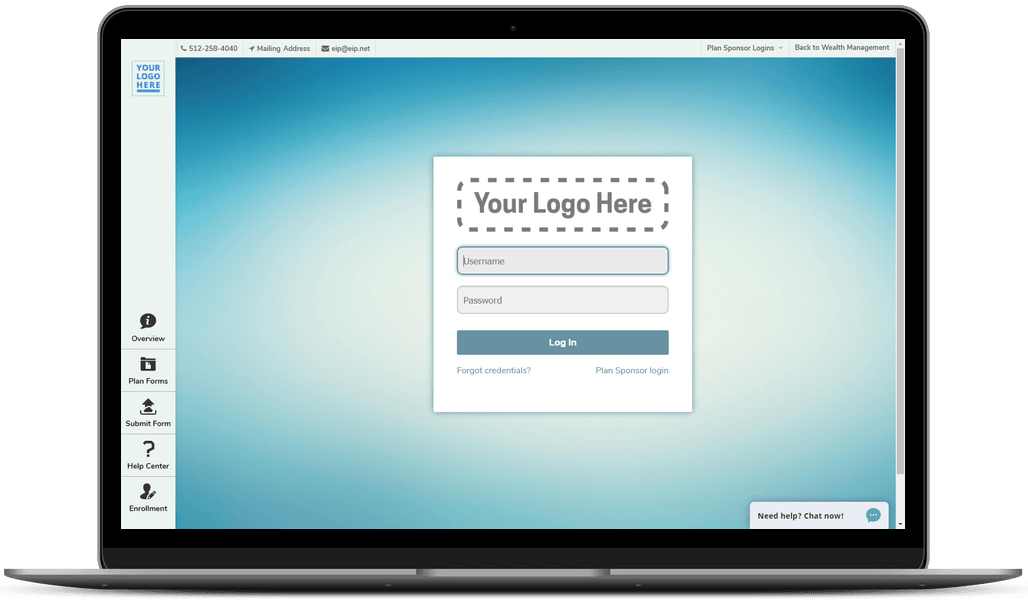

White Label Platfrom

It is importance to maintain your brand presence with your business clients.That is why most everything is white labeled!

Custom Retirement Plan Design

Tailored designs of retirement plans including plan type, vesting, match, eligibility requirements & auto enrollment.

Advisor Portal & Assistance

EIP takes a hand on approach to help our independent partners create proposals, close deals & communicate and educate recommendations.

Central Point of Contact

Whether a plan trustee wants to discuss updating their plan offerings or an employee needs guidance on enrolling, we are here to answer those questions.

Participant Enrollment Meetings & Materials

401(k) plans provide enormous benefits to participants, however communicating that value can be complicated. To help, EIP can sponsor or assist you with in-office enrollment meetings.

What is the main responsibility of the Plan Adviser?

When an advisory firm serves as the plan adviser a beneficial working relationship is established between the client, EIP & the advisory firm. The plan adviser reduces the plan sponsors burden by shifting some responsibilities, mainly ensuring the plan runs smoothly & client education onto themselves. To further assist our partners, EIP accepts the plan fiduciary role and gives our partners tools so they can provide sound, prudent insight to their clients.

As a plan adviser can my advisory firm charge a fee?

YES! Advisory fees are typically determined by complexity, number of participants & assets under management. We will work with you to benchmark your prospective plan and develop a overall competitive fee structure. Your advisory fee will be taken directly from the plan participant accounts and remitted back to you.

Depending on AUM

0.15% to 0.50%

We Bring More Than Just The Platform

Our expertise in ERISA Retirement Plans continues to be the top reason our partners stay with us. No cut-and-paste plans, instead we work with you to tailor & design a plan specifically to accomplish your clients goals & business objectives. Our software is great but we treasure our in-depth knowledge.

Learn More About Who We Are

Company History - 401(k) White Label Program

Since 1974, our company has consistently served as one of the major retirement benefit consulting & administration firms in the Texas area. We launched the White Label Program after many years of helping independent advisers & receiving operational feedback. The goal of the program is to provide our selective partners, typically financial institutions & RIA firms, a white label 401(k) solution that integrates marketing & brand recognition of their wealth management firm within the 401(k) process.

The White Label Program provides our partners the expertise, infrastructure and back-office support they need to give accurate ERISA advice and to be competitive within the 401(k) advisory business. We take care the heavy lifting of all plan obligations and laws, while operating under a co-beneficial relationship, where all parties win together. That is our promise!

Meet the Owner - Erik Anderson, CPA, CFP®, PFS, AIFA®

Erik J. Anderson, CPA, CFP®, PFS, AIFA®

Owner and President of Employee Incentive Plans, Inc.

Erik J. Anderson, CPA, CFP®, PFS, AIFA®, Owner and President of Employee Incentive Plans, Inc. graduated from Baylor University with a Bachelor of Business Administration degree in Accounting and a Master of Taxation. He began his career at PricewaterhouseCoopers in Dallas, Texas in the Personal Financial and Private Company Services division specializing in tax services for High Net Worth Individuals as well as financial and estate planning. Erik is a Certified Public Accountant, a Certified Financial Planner, and holds the Personal Financial Services and Accredited Independent Fiduciary Analyst designations.

Erik is a member of the American Institute of Certified Public Accountants, the Texas Society of Certified Public Accountants, the Financial Services Institute, as well as an adjunct professor at the University of Texas at Austin where he teaches Retirement Planning and Employee Benefits. Erik serves on the Board of Directors for the University Masonic Charitable Foundation as well as the Serving Grace Foundation, and is involved with the Scottish Rite Learning Center, The Settlement Home for Children and the Austin Symphony.